The regulations explain how a partnership makes the election. The election is valid only for the year in which it is made and cannot be revoked.

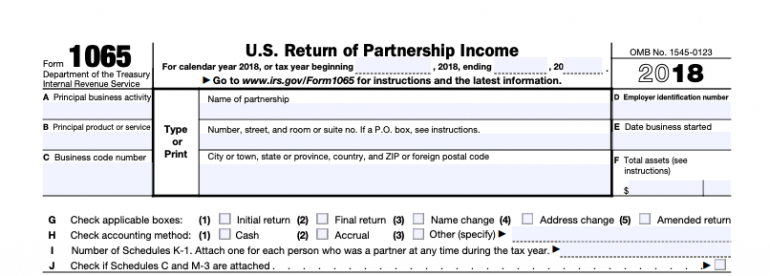

To substitute its allocations from the immediately preceding tax year when determining whether it is a syndicate. However, new regulations under IRC §448 allow a partnership to make an annual election A syndicate is considered a tax shelter that cannot use the cash method of accounting. If more than 35% of a partnership’s losses during a tax year are allocated to limited partners, the partnership is a syndicate. Tax Shelter Election in Draft 1065 Instructions The partnership includes the credit in the calculation of “Other income (loss)” on line 7 of Form 1065. A partnership must include the full amount (both the refundable and nonrefundable portions) of the credit in its gross income for the tax year, but no double tax benefit is allowed. Family and Sick Leave Payroll Credit in Draft Form 1065 InstructionsĪn eligible employer may take a credit against payroll taxes owed for amounts paid before October 1 for family leave or qualified sick leave during 2021. The expanded explanation in the draft instructions clarifies that status as a limited partner is determined under IRC §1402(a)(13) without regard for whether the partner may qualify as a limited partner under state law. A limited partner’s self-employment earnings from the partnership generally include only partnership payments for services rendered to or on behalf of the partnership. The 2021 Form 1065 draft instructions expand the explanation for limited partners, in order to help partners determine if they are limited partners for purposes of the self-employment tax.

Self-Employment Tax and Limited Partners in Draft Form 1065 Instructions Return of Partnership Income, lets practitioners familiarize themselves with the expected changes from the 2020 form and instructions. An early-release draft version of the 2021 Instructions for Form 1065, U.S.

0 kommentar(er)

0 kommentar(er)